What Have I Done? 5 Retirement Decisions that are Permanent

It’s unfortunate, but as a financial advisor in New Haven County, I often talk to retirees after they’ve made a mistake with their retirement plans. Even more unfortunate, certain decisions cannot be undone.

While there’s usually an opportunity to make up for a bad decision, it can be expensive both in time and money.

It’s my personal goal to try to reach as many pre-retirees before these mistakes are made. Proper research and the help of a qualified financial advisor can help ensure you understand how the choices you make will impact your retirement. Taking the time up front to get it right will help make the transition into retirement much smoother. Remember, retire is one of the few things in life we cannot get a “do over” for.

I’ve been in the financial services industry for a long time, and in my experience, there are 5 common areas where people go wrong.

1. When to Take Social Security

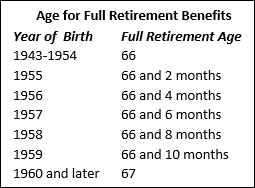

There is a direct trade-off between the age at which you claim your Social Security benefits and the size of those benefits. You can claim benefits at any age between 62 and 70, and your birth year determines when you reach full retirement age.

The significance of your full retirement age is that it’s the earliest you can receive 100 percent of your Social Security benefits without withholding. If you turned 62 and filed your claim, you would receive 29.2 percent less each year than had you waited until your full retirement age. That gap narrows each year until you attain your full retirement age, and then grows by an additional 8 percent for each year after that you postpone your claim.

You might want to wait until age 70 to claim maximum benefits, but that strategy won’t necessarily yield the highest lifetime benefit – it depends on the length of your retirement. You can use an online benefits calculator to run different scenarios to help you decide when to file your claim, but to get a true understanding of what each option entails, it’s important to use accurate projections based on your specific situation. Once you start receiving your Social Security benefits, except for a few exceptions, there’s no changing your mind. The decision is permanent.

How do you get these accurate projections? Read our recent blog post: How to Get Accurate and Realistic Retirement Projections.

Don’t guess when it comes to your retirement. Schedule a no-obligation conversation with the team at Heritage Capital.

2. How to Receive Your Pension

When it’s time to retire, pensioners must decide how to receive their money. The two main choices are:

1. Annuity: A series of monthly checks that continue for the rest of your life or until a certain date

2. Lump sum: Taking the money all at once

Lump-sum distributions can be appealing, but they have to be managed carefully and prudently or you could run out of money. Once a decision is made, there’s no going back.

Many pensioners who take the lump sum roll the money into a Traditional IRA to shield the money from taxes until withdrawn. This strategy may give you more control over your money, but you’re also left with the responsibility of making it last a lifetime.

With an annuity, you know exactly how much you’ll receive each month, and you know how long the checks will continue to come in. However, unless your pension has an inflation rider, you have no opportunity to grow your pension tax-deferred to keep up with inflation.

3. When to Start Your Retirement Planning

The best time to take Social Security benefits depends on your situation. The best time to retire varies. But when to start your retirement planning? This one is easy. Start as early as possible!

The sooner you begin planning, the better the chances that you’ll achieve the results you want. If you wait too long, you may be shocked to learn that your retirement might not work out as you envisioned. You can never get the unplanned years back, so it really makes sense to start as soon as you can.

If you’re not sure where to start, contact me directly.

4. Roth Conversions

There are two types of IRAs: Traditional and Roth. With a Traditional IRA, your contributions are tax-deductible, and they grow tax-deferred. You pay ordinary income taxes only on the money you withdraw. You don’t have to make withdrawals until age 72, at which time you must take Required Minimum Distributions (RMDs) based on your life expectancy as dictated by the IRS.

A Roth IRA doesn’t provide any tax deductions, but contributions grow tax-free. You can withdraw your contributions tax-free at any time, and you can withdraw your earnings tax-free starting five years after opening the account. Roth IRAs do not have RMDs, which means you can bequeath its full balance to your beneficiaries.

A rollover occurs when you move your retirement funds from one plan to another. For example, you can roll your Traditional 401(k) to a Traditional IRA and doing so will not trigger any taxes, assuming you do not take possession of the money for more than 60 days. A Roth conversion occurs when you roll a Traditional 401(k) or Traditional IRA into a Roth IRA. You must pay ordinary taxes on the transferred amount, but thereafter, you can distribute the money tax-free.

The advantage of a Roth conversion is that your beneficiaries will receive the proceeds tax-free (as long as the account had been opened at least five years before your passing). It can also bypass any income restrictions, giving you a tax-saving benefit at retirement that you don’t initially qualify for.

The concept may sound simple, but the elements of a conversion can be confusing and expensive. Talk to a financial advisor about whether the decision is a good one for you. Money in a Roth IRA cannot be rolled over to any other type of retirement account, so the conversion is final.

5. Taking Money from a Retirement Plan Early

Generally, money withdrawn from a traditional retirement plan before age 59-½ will be slapped with a 10 percent early withdrawal penalty on top of the normal tax bill. Both 401(k)s and IRAs provide certain exemptions from the 10 percent penalty. For example, you can avoid the penalty on an early 401(k) withdrawal if you’ve reached age 55 and are leaving your job, you’ve become totally disabled, you have medical expenses exceeding 7.5 percent of your income, or a court orders you to make payments to a divorced spouse, child or other dependent.

Similarly, the 10 percent penalty for an early IRA withdrawal will be waived for the following reasons:

- Unreimbursed medical expenses exceeding 7.5 percent of your adjusted gross income

- Health insurance premiums while unemployed

- Permanent disability that prevents you from working

- Qualified higher education expenses for you, your spouse or your children

- IRA beneficiary

- Cost of buying, building or rebuilding your home, up to $10,000, as long as you haven’t owned a home within the previous two years

- Substantially equal periodic payments for at least five years or until you reach age 59-½, whichever comes later

- To pay an IRA levy

- Called to active duty

The problem with taking money early is that you’ve permanently lost its tax-free growth. You can’t put the money back beyond the normal limits on annual contributions.

If you have a 401(k), you may be able to borrow from it. You must repay the loan (usually within five years) and pay yourself interest. This is less harmful than an early withdrawal since the loss of tax-deferred growth is only temporary. But it, too, has long-term effects. Talk to a financial advisor to see if you have other options.

The Bottom Line

In general, you don’t want to make financial decisions without first talking with your financial advisor. There may consequences with which you are not familiar if you go it alone. As a financial advisor in Connecticut, I can tell you that even seemingly small decisions can have major, long-lasting effects. Some wise words from your financial advisor can save you years of regret.

If you’re currently looking for a financial advisor to work with or feel it’s time to make a change, let’s talk.