7 Social Security Strategies Following the Pandemic

The past year has been one of unprecedented upheaval, but now, as we transition to a new normal, it’s time to take a fresh look at our finances. If you are approaching or have reached retirement age, this process should include reassessing your Social Security strategy for the post-pandemic world.

Social Security is a major element of most retirement plans; so much in fact that at Heritage Capital, we’ve created this new guide: Understanding Social Security. However, as we move past COVID-19 and any affect it’s had on our finances, there are a few new strategies to consider.

If you haven’t discussed your retirement plan with a financial advisor since the pandemic, there’s no better time than now. Financial planning post-COVID-19 looks different. Make sure you’re still maximizing your retirement strategies and remain on track to reaching your goals.

As a financial advisor in Connecticut for more than 30 years, I want to share with you 7 Social Security strategies specific to life after the pandemic. If you’d like to discuss your specific situation in more detail, which I highly recommend, let’s talk! Contact me directly and start the conversation.

Are you still on track to reaching your retirement goals? Contact Heritage Capital to see how we can help.

Strategy #1: Receive Benefits Earlier

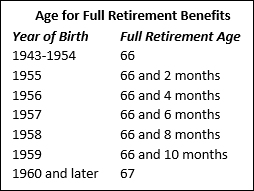

If the pandemic drained all or part of your savings, or caused you to lose your job, you may need to claim your Social Security benefits sooner than planned. The earliest you can file a claim is age 62, when you’ll lock in 70.2 percent of your Primary Insurance Amount (PIA), the benefits you would have received had you waited until you reached your full retirement age (between age 66 and 67, depending on your birth date).

Every year you wait past age 62 (up to age 70) increases the monthly amount you’ll receive, but reduces the number of years you’ll be receiving benefits.

Taking Social Security benefits early is often not recommended, but depending on how 2020 affected your finances, it could be beneficial.

Strategy #2: Stagger Benefits for Married Couples

As a financial advisor in Connecticut, I’ve helped many clients navigate a split strategy, in which the spouse with a lower PIA claims Social Security benefits first, while the spouse with a higher PIA postpones claiming until later. The thinking behind this strategy is that the benefits of the higher-PIA spouse will be worth more over time than those of the lower-PIA spouse.

The lower-PIA spouse can continue to work or retire. If work is chosen, be aware that up to 85 percent of your Social Security will be subject to taxes being withheld until you reach your full retirement age if your income exceeds a set threshold. In 2021, joint filers will have 50 percent withheld if their income falls between $32,000 and $44,000. The withholding increases to 85 percent when combined income exceeds $44,000. You will eventually recoup most of the withheld money, but it may take up to 15 years to complete the process.

For more on balancing Social Security benefits among couples, read our recent blog post: Retirement Planning Connecticut: Staggering Benefits and Retirement with Your Spouse.

Strategy #3: Work Longer to Increase Your Benefit Amount

Nowadays, many people work well into their 70s and live into their 90s. In these situations, continuing to work while waiting to claim your Social Security benefits can make a lot of sense. The benefits of continuing to work include:

- You can postpone tapping into your retirement accounts.

- You can continue to contribute to your retirement accounts.

- You can add earnings to your record that may increase your PIA.

- You let your Social Security benefit grow by postponing your claim until later.

- Your spouse may be able to retire while you continue to bring in money.

Additionally, many people like to work, as it gives their lives focus and meaning, not to mention the additional disposable income.

Strategy #4: Collect Spousal Benefits Now, Yours Later

Spousal benefits are those that you collect based on your spouse’s earnings record. The Social Security Administration (SSA) allows you to collect spousal benefits until you claim your own. You’re entitled to a percentage (32.5 to 50 percent) of your spouse’s PIA, depending on your age when you claim spousal benefits.

You must have been married at least one year to collect a spousal benefit, and your spouse must be at least 62 years old and already collecting personal benefits. The SSA will pay the greater of your personal or spousal income.

A special case, called restricted application, is available to couples in which at least one person was born before January 1, 1954. Through restricted application, you can claim spousal benefits based on your spouse’s earnings record even if your spouse has not yet claimed. Your spousal claim will have no effect on you or your spouse’s personal benefit.

Strategy #5: Delay Benefits to Later

The longer you delay claiming your Social Security benefits, the higher your monthly payments will be. The two important factors are your full retirement age and your PIA. This table summarizes the situation:

The rules are as follows:

- If you claim your benefits before your full retirement age, you’ll earn less than your PIA. The amount begins at 70.2 percent of your PIA if you claim at age 62, and the amount increases each year you delay. Once you reach your full retirement age, you are eligible to receive 100 percent of your PIA.

- Your benefit will continue to grow by 8 percent per year if you delay your claim beyond your full retirement age. The benefit maxes out when you reach age 70.

If you wish to maximize your monthly benefit, you can delay filing a claim until age 70. But talk to a financial advisor before making a decision. Determine your break-even age to ensure you get the maximum amount you’re eligible to receive.

Strategy #6: Take Advantage of Survivor Benefits

If your spouse (or ex-spouse) has passed away, you may be entitled to survivor benefits as early as age 60. The amount you receive depends on when you file your claim. If you’ve reached your full retirement age, you can claim 100 percent of your spouse’s benefits. Before your full retirement age, you can claim between 71.5 and 99 percent of your spouse’s benefits, starting at age 60. If you are disabled, you can claim survivor benefits at age 50. There are also special rules for claiming survivor benefits when you are caring for a child who is under 18 or disabled.

Strategy #7: Know Your Break-Even Ages and What Your Options Look Like

Your break-even age is when the total of the smaller benefits you receive when filing early (i.e., before reaching your full retirement age) equals the total amount you would have collected had you waited to file until later.

A financial advisor can help you determine your break-even age while also addressing your life expectancy and other factors. You may be better off filing for Social Security benefits earlier if you are unlikely to reach your break-even age.

When it comes to Social Security benefits, you have options. Collaborating with a financial advisor can help you understand those options and ultimately choose those that give you the greatest benefits.

Social Security rules are complicated. Don’t make a mistake that permanently costs you money. Schedule a no-obligation conversation today.