Your FRA and What It Means to Your Finances

When it comes to retirement, knowing your Full Retirement Age, or FRA, is just as vital as knowing your Social Security number and your birthdate – that “magic number” determines when you can start taking your full Social Security benefits, how much you’ll receive, and ultimately, how much money you’ll have in retirement.

While Social Security likely won’t supply the bulk of your retirement income, especially for those planning a high net worth retirement, your benefits will play a crucial role in your overall retirement plan as “guaranteed” income for life.

There are a few common places where people go wrong when it comes to their Social Security benefits. Not understanding how their FRA affects the amount they receive is one of them.

Once you know your FRA, the amount you receive in Social Security benefits depends on 3 elements:

- Your age when you file your claim

- Your lifetime earnings as reflected in your work record

- The lifetime earnings of your spouse (when figuring survivor and spousal benefits)

One of the biggest retirement fears people share with me is running out of money later in life. Making a well-thought-out decision about when to start taking your Social Security benefits is part of how you ensure that doesn’t happen.

What Is Your FRA?

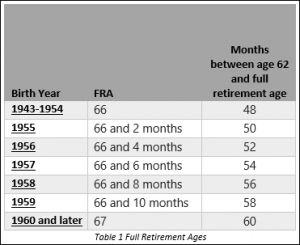

Your FRA is the age at which you can first claim 100 percent of your Social Security benefits. The following table, courtesy of the Social Security Administration (SSA), summarizes the FRAs of individuals born since 1943. It shows the FRA by birth year and also the number of months between age 62 (when you can first claim benefits) and your FRA.

The FRA of those born before 1955 is 66. That number gradually increases from 1955 to 1959. All those born from 1960 on, have a FRA of 67. There are a few notes to consider:

- When figuring your FRA (and your benefit), birthdays on the first of a month are treated as if it occurred in the previous month.

- With that said, if your birthday was January 1, your FRA and benefit are figured as if it occurred in December of the previous year.

- If you start taking benefits at age 62, you must be 62 for the full month before you start receiving benefits.

For more on Social Security benefits, check out our new guide: Understanding Social Security.

Don’t make a rash decision on when you should start claiming Social Security benefits. Contact Heritage Capital and let us run different scenarios for you so you fully understand your options.

How Much Will You Get If You Claim Social Security Benefits AT Your FRA?

You are eligible for 100 percent of your Social Security benefits if you file your claim at your FRA. How much that represents depends on your employment history.

The SSA looks at the 35 years in which you earned the most money, indexes it for inflation and calculates your Average Indexed Monthly Earnings (AIME). The SSA then uses your AIME to compute the basic benefit (or “primary insurance amount”) you would receive at your FRA. You can visit the SSA website to review your FRA and benefits by age, but to fully understand what it means for your specific situation, talk with your financial advisor about different scenarios. At Heritage Capital, we can run all kinds of Social Security analysis, from breakeven on different ages to claiming strategies for spouses.

This is important, because the actual monthly benefit you’ll receive can be modified by certain factors. The most important of these is when you file your claim. Your earnings must have been subject to Social Security taxes for them to count in your benefit calculation. If you were a government worker, for example, who didn’t pay Social Security taxes on your income (because you were enrolled in an exempt retirement or disability pension), the SSA will apply a different formula to calculate your AIME. The SSA publishes these arcane calculations if you’re interested.

How Much Will You Get If You Claim BEFORE Your FRA?

Your benefit will be smaller than 100 percent if you claim benefits before reaching your FRA. The benefit is reduced for each month between your age at claiming and your FRA.

The amount of benefit reduction is as follows:

- For each of the first 36 months before your FRA: 5/9 of 1% (or 0.5556%).

- For each subsequent month before your FRA: 5/12 of 1% (or 0.4167%).

On an annualized basis, your benefit is reduced by 6.7 percent per year for the first three years of early retirement and an additional 5 percent for each following year before your FRA.

Note that your benefits will be withheld by the IRS until you reach your FRA if you earn more than certain threshold amounts. Once you attain your FRA, you can receive your full benefit (including previously withheld amounts) without any further withholding.

How Much Will You Get If You Claim AFTER Your FRA?

Claiming your benefit at ages above your FRA will result in larger payments. Benefits increase by 2/3 of 1 percent for each month (or 8 percent per year) you wait, up to the maximum claiming age of 70.

Thus, if your benefit at your FRA of 66 was $2,000/month, waiting until age 70 would give you a benefit of $2,640/month.

These calculations do not include cost-of-living adjustments.

How Much Will You Need in Retirement?

Probably the most common question I’m asked as a financial advisor is, “How much will I need to save to have enough income when I quit working to have the retirement lifestyle I want?”

There are 5 steps to answering this question:

- Calculate how much money you will need to live the lifestyle you want in retirement. Include items like housing, basic living expenses, education, entertainment and charity.

- Adjust the above number for anticipated post-retirement lifestyle changes.

- Subtract expected cashflows, such as Social Security benefits and Required Minimum Distributions (RMDs) from your retirement accounts.

- Estimate your rate of return on your savings and investments.

- Calculate this number divided by anticipated rate of return.

As you can see, the longer you wait to take your Social Security benefits, the less you’ll have to save on your own. Keep this in mind when you decide when to file your claim for Social Security benefits.

Retirement planning for high net worth individuals can be especially complicated. If you’re ready to have a serious conversation about your Social Security benefits and retirement, schedule a no-obligation consultation with the Heritage Capital team. It’s never too early to start planning for the future.