Bulls Firmly in Control But 4000 Should Start Pause

The stock market is having a good week. The nasty reversal on Monday didn’t even give the bears satisfaction for 24 hours. It turned out to be a trap and stocks immediately soared higher again. Below is an update of the chart I posted last week with price filling in for where I had my light blue lines to generally forecast the next few weeks. S&P 4000 is within reach and that would fill the remaining gap left from the plunge June 10th.

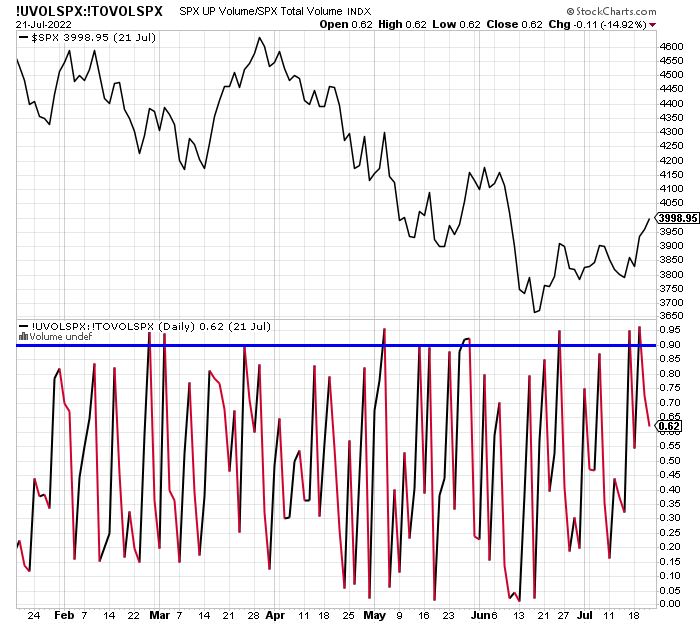

The chart below shows the “thrust” I mentioned the other day with the surge in buying interest. The S&P 500 is the top chart and the amount of volume in stocks going versus down is in the lower chart. The horizontal blue line is the 90% level which really indicates powerful buying the S&P 500 stocks. 90% of the daily volume was in stocks going up. We saw that two out of three days ending on Tuesday. Now the bulls need to prevent any 90% down days.

As the S&P 500 approaches 4000, I would expect some pause to refresh or a mild pullback. It would be unlikely, but super powerful to see the index blow right through 4000 and on to 4100 quickly.

On Wednesday we sold levered Russell 2000 and some levered NDX. On Thursday we bought FUTY, VGK, levered inverse S&P 500 and more GDX, NUGT, ARAY. We sold WDS.

The beautiful late spring and early summer weather has turned into a relentless heat wave in New England. Not loving the high heat and humidity. With Renee on vacation at least I can crank the AC in the office.