Stock Market Due for a Proper Correction in 2022

In a recent interview with FOX61, Paul Schatz, President of Heritage Capital shares the 2022 financial markets forecast and headwinds to prepare for. Listen to what he says you can do to make sure your finances stay stable in the current environment.

Last year we witnessed the Standard and Poor’s 500 (S&P 500) rise by a spectacular 27% despite worries over COVID, inflation, and rising interest rates. Those high-net-worth investors pursuing high-net-worth investing strategies were suitably rewarded for sticking with aggressive asset allocations in 2021.

However, the new year is looking riskier, fraught with landmines and merits some portfolio rebalancing. We’re not looking for a significant bear market in 2022, but the economic and political environment should reward investors who move some assets from equities to fixed-income investments.

Your Retirement Fears Need to be Acknowledged. Connect with Heritage Financial Advisors for Genuine Guidance.

What We Think Is Coming for 2022

It’s always hard to fight momentum, and the stock market has turned in some pretty good performances in the last three years. We’re looking at some disturbing indicators for 2022 that could produce a correction of 10% to 15%, including the following:

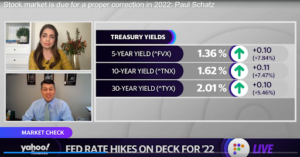

Interest Rates

The Fed is going to raise short-term interest rates and allow long-term interest rates to naturally rise. The 10-year Treasury has pierced the 1.7% yield level and is probably heading toward 2% in the first quarter. Those looking for higher coupons should be rewarded. The Fed won’t allow interest rates to reach their natural levels – 3% to 4% given our $30 trillion national debt.

Bonds should do OK in 2022, but don’t look for spectacular results. Buying on weakness, especially in Q1, is a good play, especially if inflation declines later in the year. Higher yields compete with stock returns and presage costlier borrowing for corporations, depressing profits and pressing P/E ratios even higher. That’s not a favorable environment for equities.

Volatility

Volatility

Volatility will rise in 2022, as the Fed becomes restrictive, geopolitical instability in Eastern Europe, negative earnings surprises, and possible new COVID strains beyond Omicron could whipsaw stocks. Investors with a shorter time horizon might want to tinker with their sector picks, as we don’t think that the year will see a rising tide lifting all boats.

Tech stocks had a great 2021, but more interesting sectors include the large caps, international equities, and consumer goods.

Inflation

Currently, inflation is rising and at levels not seen since 1981. The year-over-year 7% increase in consumer prices for December 2021 was the fastest pace in 40 years. However, the Fed is winding down its asset repurchase program and should start raising interest rates in the next couple of months. This may indicate that we’ve already hit the high-water mark for monthly increases in inflation as the Fed tightens control.

A consensus among economists is that inflation will fall significantly. They point to easing the crunch for goods thanks to better supply chain performance and slower demand growth resulting from less fiscal stimulation. That might be too optimistic, given expected rises in wages and rents.

Thus, the 2022 inflation forecast is murkier than previously thought, adding to stock volatility throughout the year.

GDP

GDP growth slows down in 2022, with real change shrinking to 3.3% if inflation hits the 4% mark. Slackening demand, the Omicron variant, and higher interest rates will take their toll on GDP.

Earnings

S&P earnings growth slows down in 2022 after a blistering 46% increase in 2021, with P/E ratios hitting 21X. The 2022 consensus forecast is for an 8.7% increase in earnings, a slowdown in the growth rate that will further imperil the Index’s already overvalued P/E ratios.

Higher interest rates are the principal culprit, but weaker demand will play a part. Earnings shouldn’t fall out of bed, but they don’t look like they’ll support a strong equities market in 2022.

All in all, 2022 will not be an excellent year for equity stocks. However, we don’t forecast a recession, and equities may eke out a gain before the year’s end. The risk/reward ratio favors a higher asset allocation toward bonds and lighter stock holdings for the year.

How to Protect Your Assets and Retirement Accounts in 2022

Your retirement fears need to be acknowledged. As always, your retirement planning should emphasize long-term investing strategies, not responding to the daily or weekly market gyrations. We advise patience – 2022 equity investments will not see double-digit growth but rather small losses or, at best, modest gains.

We advise patience – 2022 equity investments will not see double-digit growth but rather small losses or, at best, modest gains.

Because forecasts are inherently unreliable and the future is always unclear, we caution investors to avoid overreacting to current events. Instead, a careful rebalancing of your diversified portfolio is your best defense against changes in the investing environment.

Whether you are adding to savings for retirement or just learning about investment portfolios, we have some tips! As you reallocate your money to various asset classes in 2022, consider the following recommendations:

- Bonds may be a decent, lower-risk investment. You may want to reduce your equity allocation in favor of fixed-income instruments.

- In an uncertain to a slightly hostile environment for equities, you should look to lower your overall risk with quality mutual funds, ETFs, and stocks with dividends.

- Consumer goods and utilities are excellent defensive plays, as are mega-cap, non-technology stocks. Many long-term investors favor buying mutual funds and ETFs mirroring the S&P 500 Index because it is a highly diversified portfolio requiring minimal expense ratios (typically lower than 0.02%). For unsheltered portfolios, S&P 500 ETFs are tax-efficient, with little turnover.

We want to offer a word to aggressive investors about how to recover from financial loss. You may have worked with a broker or advisor who was more interested in short-term trading than long-term results.

Often, taking overly risky positions can cost you a bundle, not only in trading losses but also commissions. If you are unhappy with your results, you might want to consider changing investment advisors. Honest investment management is the foundation of practical personal finance.

Our firm doesn’t want our clients to emotionally chase short-term trends, like SPACs and cryptocurrenices. Trying to trade the market without a well-thought out plan is usually a fool’s errand, and very few can consistently do so profitably. Instead, holding a highly diversified portfolio across many asset classes and strategies is a time-proven way to reduce overall risk, lower investment costs, and prevent ulcers.

We invite you to contact us and learn more about our approach to our fiduciary responsibilities. Putting our clients’ needs first has always been our primary mission, and we are committed to that promise, whatever the markets may have in store. This is our promise to you!